You are currently browsing the tag archive for the ‘jobs’ tag.

Good grief. 7 Months After Stimulus 49 of 50 States Have Lost Jobs

T shirt from OMama!Obama?

America Now Over 6 Million Jobs Shy of Administration’s Projections

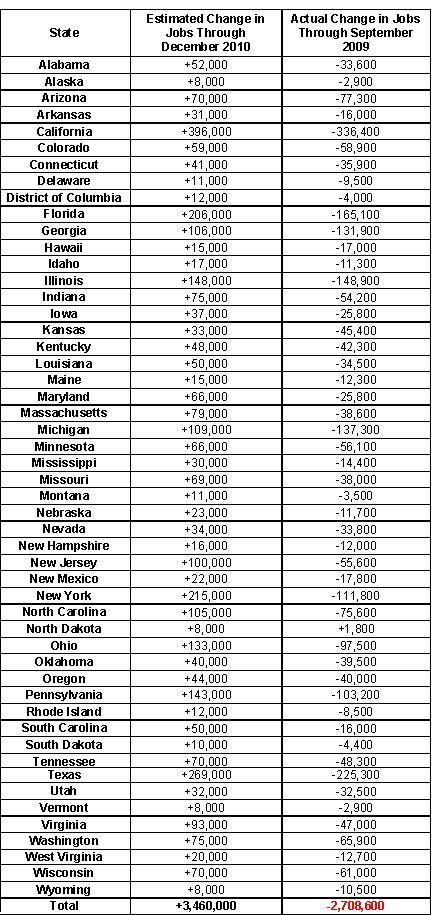

The table below compares the White House’s February 2009 projection of the number of jobs that would be created by the 2009 stimulus law (through the end of 2010) with the actual change in state payroll employment through September 2009 (the latest figures available). According to the data, 49 States and the District of Columbia have lost jobs since stimulus was enacted. Only North Dakota has seen net job creation following the February 2009 stimulus.

Why this epic fail? The Myth of the Multiplier.

Reality bites one politician.

Another stimulus in the offing? Lawmakers Weigh Measures to Spur Hiring, Short of a Second Stimulus

H/T Instapundit

It’s in the eye of the beholder. $2.3 million in federal stimulus money is going to pay for Tampa Bay area beauty school tuition

More than $2.3 million in federal economic stimulus grants have gone to eight Tampa Bay area cosmetology and massage schools to pay tuition for the hairdressers, masseuses and nail technicians of tomorrow.

That’s swell news for those who see the beauty trades as a way to gain a firmer footing in the job market. But is there truly demand for more beauty school graduates at bay area salons?

Not really, said Monica Ponce, owner of Muse The Salon in Tampa.

“Instead of encouraging more people to go to beauty schools,” Ponce said, “they should probably help the stylists who are unemployed.”…

Silly rabbit, the money’s meant to grow entitlement programs, pay off special interest groups and make more people love government intervention.

…The stimulus money is being paid to beauty schools in the form of Pell Grants, which are awarded to low-income students. The grants don’t have to be repaid.

The government doesn’t allocate the money based on an assessment of what kinds of job skills are in demand. Rather, students apply to the government for the grants and if eligible can put the money toward the vocational school, college or university to which they’ve been accepted.

The government sends the grant money directly to schools.

The stimulus bill includes $17 billion to boost the Pell Grant program and raise the maximum annual award from $4,731 to $5,350.

See? The stimulus is working — it’s saving all those Pell Grant bureaucrats’ and beauty school teaching jobs, along with the other half a million jobs Vice President Joe Biden takes credit for saving.

Putting fish first. From USA Today, Calif. farmers say feds make drought worse

FIREBAUGH, Calif. — The road to Todd Allen’s farm wends past irrigation canals filled with the water that California’s hot Central Valley depends on to produce vegetables and fruit for the nation. Yet not a drop will make it to his barren fields.

Three years into a drought that evokes fears of a modern-day dust bowl, Allen and others here say the culprit now isn’t Mother Nature so much as the federal government. Court and regulatory rulings protecting endangered fish have choked the annual flow of water from California’s Sierra mountains down to its people and irrigated fields, compounding a natural dry spell.

“This is a regulatory drought, is what it is,” Allen says. “It just doesn’t seem fair.”

More at the link.

The Senate’s healthcare reform bill is not. Health Care Bill Would Curb Job Growth by Encouraging Small Businesses to Remain Small

The Senate version of President Obama’s government health care overhaul contains a mandate that all businesses provide their employees with health insurance or pay a fine, unless the business employs fewer than 25 people. Critics say the 25-employee benchmark could stifle small business growth by prompting companies to limit themselves to 24 employees.

The mandate, called the “shared responsibility of employers,” says that businesses must provide their employees health insurance or else pay an annual fine of $750 per employee per year ($375 for each part-time employee).

The bill exempts “small” companies, which are defined as any company that employs fewer than 25 people at any time during the year.

More federal meddling in the private sector:

Another possibly detrimental provision is one that concerns new businesses. The Senate bill mandates that for start-up companies, the government will estimate how many employees that new company might need – and it will use that estimate to determine if the new firm is exempt from providing their employees health insurance.

“[T]he determination of whether such [new] employer is a small or large employer shall be based on the average number of employees that is reasonably expected such employer will employ,” the bill says.

Moffit said this provision will amount to government determining how big a new business can be, because no new employer will want to run afoul of the government mandate.

Unbelievable. Is there no one in Washington who considers consequences of legislation? More at the link.

Not only won’t jobs created by the stimulus last very long, they cost taxpayers a fortune. From the Foundry, $413.6 Million in Stimulus for 34 Full Time Jobs

…So far, a total of 50 jobs have been created by the funding, 34 of them full time. The OES will be headed by a director whom Gov. John Lynch has not yet appointed. All five OES jobs are described as full-time temporary positions that will go out of existence in September 2011, the end of the federal fiscal year.

More at the link.

Democrats Admit That Their Cap and Trade Bill Is a Job Killer

In her remarks bringing the debate over the climate bill to a close, House Speaker Nancy Pelosi of California urged her colleagues to vote in favor of the cap and trade bill, saying the measure was about four things: “jobs, jobs, jobs, and jobs.”

She was right—the House-passed version of cap and trade is all about jobs: jobs lost, jobs never created, jobs sent overseas, and, unbelievably, jobs people will be paid for doing long after they cease to exist.

According to Friday’s Washington Times, the legislation includes language that provides, should it become law, that people who lose their jobs because of it “could get a weekly paycheck for up to three years, subsidies to find new work and other generous benefits—courtesy of Uncle Sam.”

How generous are these benefits? Well, according to the Times, “Adversely affected employees in oil, coal and other fossil-fuel sector jobs would qualify for a weekly check worth 70 percent of their current salary for up to three years. In addition, they would get $1,500 for job-search assistance and $1,500 for moving expenses from the bill’s ‘climate change worker adjustment assistance’ program, which is expected to cost $4.2 billion from 2011 to 2019.”

Instead of being a the source of millions of new jobs of “green jobs”—as House Democrats are fond of saying over and over again—the provision is a hidden admission that their effort is a job killer, not just a massive new tax on energy.

More at the link.

Told you so, Nancy.

The White House: W. House: 10 Percent Unemployment Within Months

The U.S. unemployment rate is likely rise from already high levels to 10 percent in the next couple of months, a White House spokesman said on Monday.

“I think the president has said this, and I would certainly say this, I think you’re likely to see unemployment at 10 percent within the next couple of months,” White House spokesman Robert Gibbs told reporters.

The U.S. unemployment rate already stands at 9.4 percent, the highest level in about 25 years, and many analysts believe it could continue to climb despite the $787 billion economic stimulus package passed early this year by Congress.

Somebody tell the Senate: Senate Democratic Leader Wants New Guest Worker Program Despite Recession and High Unemployment Rate

Senate Majority Leader Harry Reid (D.-Nev.) says he wants to enact a new guest worker program as part of a comprehensive immigration reform bill that he is vowing to take up in Congress.

Reid announced his intention to enact a new guest worker program last week despite the fact that the economy is in a deep recession and the national unemployment rate has reached 9.4%, a level that has not been seen since 1983 and that is rare in the post-World War II era.

…The most recent data from the Bureau of Economic Analysis indicates that the U.S. economy was still contracting as of March. In the first quarter of this year, the real Gross Domestic Product of the United States dropped at an annual rate of 5.7 percent. In the fourth quarter of last year, it dropped by 6.3%.

A Monday-morning math lesson from OpenMarket.org: Stimulus = Welfare + Quotas + Corruption

Obama’s $787 billion stimulus package is now being used to force states to adopt racial quotas in government contracts, even if their state constitution or civil-rights laws forbid such quotas. Slate’s Mickey Kaus reports that “CalTrans, the huge state agency that spends billions in federal highway construction funds, ’sets a quota of having 6.75 percent of contracts go to women or members of a targeted group–African American, Asian-Pacific American, and Native American.

…Obama claimed the stimulus package was needed to prevent the economy from suffering from “irreversible decline,” but the Congressional Budget Office admitted that the stimulus package would shrink the economy “in the long run.” The stimulus package has since destroyed thousands of jobs in America’s export sector, and subsidized countless examples of government waste and corruption.

It repealed welfare reform, too. Much more at the link.

So how’s the economy looking today? Not so hot.

The price of oil is expected to continue to rise for the rest of the year.

The private sector lost over 530,000 jobs last month.

The current unemployment rate is 8.9%, with no end in sight.

The Federal Government is hiring at a good clip.

Benefit spending soars to new high:

The recession is driving the safety net of government benefits to a historic high, as one of every six dollars of Americans’ income is now coming in the form of a federal or state check or voucher.

Benefits, such as Social Security, food stamps, unemployment insurance and health care, accounted for 16.2% of personal income in the first quarter of 2009, the Bureau of Economic Analysis reports. That’s the highest percentage since the government began compiling records in 1929.

In all, government spending on benefits will top $2 trillion in 2009 — an average of $17,000 provided to each U.S. household, federal data show. Benefits rose at a 19% annual rate in the first quarter compared to the last three months of 2008.

The White House says this year’s budget deficit will be nearly $2 trillion.

Today the national debt clocks in at $ 11,389,630,874,095.46.

The estimated population of the United States is 306,306,828, so each citizen’s share of this debt is $37,183.73.

Deficit spending means government borrowing. The Foundry warns of a global government debt bubble:

As governments worldwide try to spend their way out of recession, many countries are finding themselves in the same situation as embattled consumers: paying higher interest rates on their rapidly expanding debt.

Increased rates could translate into hundreds of billions of dollars more in government spending for countries like the United States, Britain and Germany.

Even a single percentage point increase could cost the Treasury an additional $50 billion annually over a few years — and, eventually, an additional $170 billion annually.

…The long-term situation is particularly perilous, because the added interest costs will worsen what have become record deficits as Washington has rushed to bail out industries and stimulate the economy.

Making this no surprise: Bernanke Warns Deficits Threaten Financial Stability

Federal Reserve Chairman Ben S. Bernanke said large U.S. budget deficits threaten financial stability and the government can’t continue indefinitely to borrow at the current rate to finance the shortfall.

“Unless we demonstrate a strong commitment to fiscal sustainability in the longer term, we will have neither financial stability nor healthy economic growth,” Bernanke said in testimony to lawmakers today. “Maintaining the confidence of the financial markets requires that we, as a nation, begin planning now for the restoration of fiscal balance.”

Bernanke’s comments signal that the central bank sees risks of a relapse into financial turmoil even as credit markets show signs of stability. He said the Fed won’t finance government spending over the long term, while warning that the financial industry remains under stress and the credit crunch continues to limit spending.

…“Either cuts in spending or increases in taxes will be necessary to stabilize the fiscal situation,” Bernanke said in response to a question. “The Federal Reserve will not monetize the debt.”

Congress agrees, they say:

House Majority Leader Steny Hoyer told reporters that Bernanke “is absolutely right, we need to be very concerned about incurring additional indebtedness.” The House plans to pass legislation before its July 4 recess to cut spending in one category before increasing it in another, he said. In addition, “we need to address entitlements.”

They can start by scrapping plans for universal healthcare, which would be the mother of all entitlements. And that legislation he’s talking about sounds like it would just shift spending, not decrease it overall. No word on Congress’s attitude toward raising taxes in the article.

The Financial Times says he’s on target:

The bottom line is that we should come away from Mr Bernanke’s testimony with at least two conclusions: the chairman seems more cautious about the growth outlook when compared with other recent public statements; and he wants to push fiscal sustainability issues clearly away from the Fed’s domain and back where they belong, with Congress and the administration. He is correct on both counts. He would have been justified on Wednesday in being even more forceful; and he mostly probably will be in the next few months.

Not a good day in the neighborhood.