You are currently browsing the tag archive for the ‘national debt’ tag.

So how’s the economy looking today? Not so hot.

The price of oil is expected to continue to rise for the rest of the year.

The private sector lost over 530,000 jobs last month.

The current unemployment rate is 8.9%, with no end in sight.

The Federal Government is hiring at a good clip.

Benefit spending soars to new high:

The recession is driving the safety net of government benefits to a historic high, as one of every six dollars of Americans’ income is now coming in the form of a federal or state check or voucher.

Benefits, such as Social Security, food stamps, unemployment insurance and health care, accounted for 16.2% of personal income in the first quarter of 2009, the Bureau of Economic Analysis reports. That’s the highest percentage since the government began compiling records in 1929.

In all, government spending on benefits will top $2 trillion in 2009 — an average of $17,000 provided to each U.S. household, federal data show. Benefits rose at a 19% annual rate in the first quarter compared to the last three months of 2008.

The White House says this year’s budget deficit will be nearly $2 trillion.

Today the national debt clocks in at $ 11,389,630,874,095.46.

The estimated population of the United States is 306,306,828, so each citizen’s share of this debt is $37,183.73.

Deficit spending means government borrowing. The Foundry warns of a global government debt bubble:

As governments worldwide try to spend their way out of recession, many countries are finding themselves in the same situation as embattled consumers: paying higher interest rates on their rapidly expanding debt.

Increased rates could translate into hundreds of billions of dollars more in government spending for countries like the United States, Britain and Germany.

Even a single percentage point increase could cost the Treasury an additional $50 billion annually over a few years — and, eventually, an additional $170 billion annually.

…The long-term situation is particularly perilous, because the added interest costs will worsen what have become record deficits as Washington has rushed to bail out industries and stimulate the economy.

Making this no surprise: Bernanke Warns Deficits Threaten Financial Stability

Federal Reserve Chairman Ben S. Bernanke said large U.S. budget deficits threaten financial stability and the government can’t continue indefinitely to borrow at the current rate to finance the shortfall.

“Unless we demonstrate a strong commitment to fiscal sustainability in the longer term, we will have neither financial stability nor healthy economic growth,” Bernanke said in testimony to lawmakers today. “Maintaining the confidence of the financial markets requires that we, as a nation, begin planning now for the restoration of fiscal balance.”

Bernanke’s comments signal that the central bank sees risks of a relapse into financial turmoil even as credit markets show signs of stability. He said the Fed won’t finance government spending over the long term, while warning that the financial industry remains under stress and the credit crunch continues to limit spending.

…“Either cuts in spending or increases in taxes will be necessary to stabilize the fiscal situation,” Bernanke said in response to a question. “The Federal Reserve will not monetize the debt.”

Congress agrees, they say:

House Majority Leader Steny Hoyer told reporters that Bernanke “is absolutely right, we need to be very concerned about incurring additional indebtedness.” The House plans to pass legislation before its July 4 recess to cut spending in one category before increasing it in another, he said. In addition, “we need to address entitlements.”

They can start by scrapping plans for universal healthcare, which would be the mother of all entitlements. And that legislation he’s talking about sounds like it would just shift spending, not decrease it overall. No word on Congress’s attitude toward raising taxes in the article.

The Financial Times says he’s on target:

The bottom line is that we should come away from Mr Bernanke’s testimony with at least two conclusions: the chairman seems more cautious about the growth outlook when compared with other recent public statements; and he wants to push fiscal sustainability issues clearly away from the Fed’s domain and back where they belong, with Congress and the administration. He is correct on both counts. He would have been justified on Wednesday in being even more forceful; and he mostly probably will be in the next few months.

Not a good day in the neighborhood.

This is interesting. When Will the Press Catch On to Uncle Sam’s Collections Meltdown?

Through March, federal receipts were running 14% behind the previous year. Each month during the fiscal year has trailed the previous year, and degree of the difference has steadily increased.

There are charts detailing the decrease in Federal intake by month and Treasury receipts by type of tax collected, which are way down compared to a year ago.

Just for the month of April the decrease is 39%. Remarkable, considering that the economy shrank just 1.74% in the last six months of 2008.

You’d think it would rate a headline or two.

Speaking of income and outgo,the national debt is $11,198,173,016,379.78 today, with each citizen’s share being $36,588.04.

Thanks to Instapundit

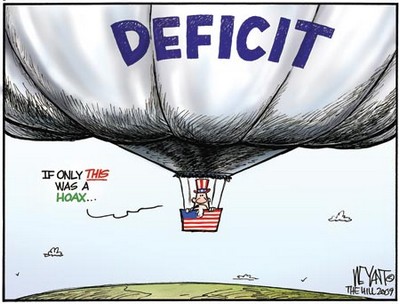

It’s the Debt Star!

Via Instapundit

Secretary of State Clinton wants to keep China in the T-bill business: Clinton wraps Asia trip by asking China to buy US debt

US Secretary of State Hillary Clinton Sunday urged China to keep buying US debt as she wrapped up her first overseas trip, during which she agreed to work closely with Beijing on the financial crisis.

Clinton made the plea shortly before leaving China, the final stop on a four-nation Asian tour that also took her to Japan, Indonesia and South Korea, where she worked the crowds to try to restore America’s standing abroad.

In Beijing, she called on authorities in Beijing to continue buying US Treasuries, saying it would help jumpstart the flagging US economy and stimulate imports of Chinese goods.

“By continuing to support American Treasury instruments the Chinese are recognising our interconnection. We are truly going to rise or fall together,” Clinton said at the US embassy here.

… China is the top holder of US Treasury bills, with 696.2 billion dollars worth of the securities in December followed by Japan with 578.3 billion dollars, according to the latest official data from Washington.

China’s economic growth is at its slowest rate in about two decades as foreign demand for its exports, including in the recession-hit United States, have dried up.

Yang indicated Saturday that China would not deviate drastically from its US Treasury policies, but gave no overt promises either way.

Maybe this is one reason why no promises were given: Road to riches ends for 20 million Chinese poor

In the past months, about 70,000 factories nationwide have closed. Beijing official Chen Xiwen estimates about 20 million migrant workers have lost jobs. Tens of thousands of villages in the countryside depend on migrant workers’ income.

… Some analysts have suggested that a “rural revolution” is imminent amid the economic turmoil. However, Wenran Jiang says such talk is premature. But he also says the central government must do more in the coming months.

“Many migrant workers have lived a very hard and simple life,” he says. “They have some savings for a rainy day like this, so in the short-term they may be able to cope — but if eight or 12 months later things continue to deteriorate, it could turn volatile.”

H/T Instapundit