You are currently browsing the tag archive for the ‘Economy’ tag.

Good grief. 7 Months After Stimulus 49 of 50 States Have Lost Jobs

T shirt from OMama!Obama?

America Now Over 6 Million Jobs Shy of Administration’s Projections

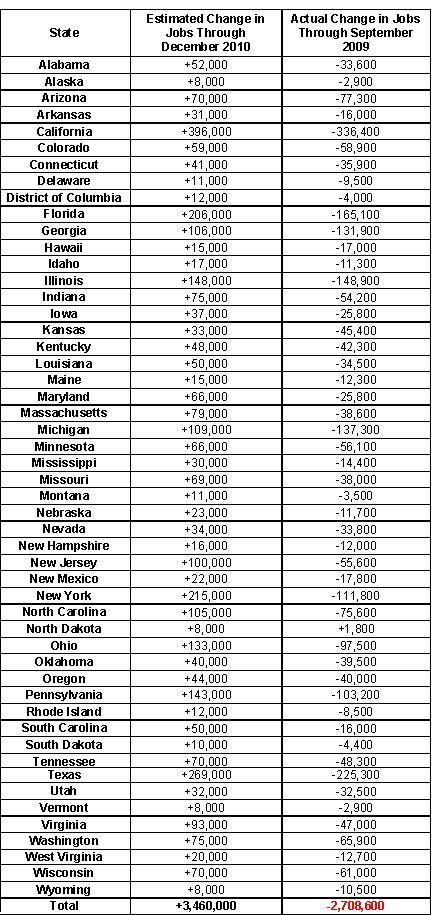

The table below compares the White House’s February 2009 projection of the number of jobs that would be created by the 2009 stimulus law (through the end of 2010) with the actual change in state payroll employment through September 2009 (the latest figures available). According to the data, 49 States and the District of Columbia have lost jobs since stimulus was enacted. Only North Dakota has seen net job creation following the February 2009 stimulus.

Why this epic fail? The Myth of the Multiplier.

Reality bites one politician.

Another stimulus in the offing? Lawmakers Weigh Measures to Spur Hiring, Short of a Second Stimulus

H/T Instapundit

It’s in the eye of the beholder. $2.3 million in federal stimulus money is going to pay for Tampa Bay area beauty school tuition

More than $2.3 million in federal economic stimulus grants have gone to eight Tampa Bay area cosmetology and massage schools to pay tuition for the hairdressers, masseuses and nail technicians of tomorrow.

That’s swell news for those who see the beauty trades as a way to gain a firmer footing in the job market. But is there truly demand for more beauty school graduates at bay area salons?

Not really, said Monica Ponce, owner of Muse The Salon in Tampa.

“Instead of encouraging more people to go to beauty schools,” Ponce said, “they should probably help the stylists who are unemployed.”…

Silly rabbit, the money’s meant to grow entitlement programs, pay off special interest groups and make more people love government intervention.

…The stimulus money is being paid to beauty schools in the form of Pell Grants, which are awarded to low-income students. The grants don’t have to be repaid.

The government doesn’t allocate the money based on an assessment of what kinds of job skills are in demand. Rather, students apply to the government for the grants and if eligible can put the money toward the vocational school, college or university to which they’ve been accepted.

The government sends the grant money directly to schools.

The stimulus bill includes $17 billion to boost the Pell Grant program and raise the maximum annual award from $4,731 to $5,350.

See? The stimulus is working — it’s saving all those Pell Grant bureaucrats’ and beauty school teaching jobs, along with the other half a million jobs Vice President Joe Biden takes credit for saving.

Good article by Victor Davis Hanson, The Power of Payback:

…The Greeks remind us that when success and bounty arrive, then, especially, it is time to be self-effacing, modest, generous, and forgiving. If not, retribution follows—whether because human nature dictates that the crowd wishes misfortune upon the haughty, or, as I confess that I believe, there is a sort of divine force that seeks to remind us of our own folly and can only do that in appropriately dramatic and timely fashion.

If it were true that the financial meltdown of last September and the tough time in Iraq were reminders to the Bush administration that once around 2003, coming off Wall Street surges and easy victories in Afghanistan and Iraq, they should have calmed down, and treaded softly (rather than ‘mission accomplished’ and ‘bring ‘em on’), so too Obama should have feared the goddess last winter…

Much more at the link.

Vote.

Of times of crisis and opportunity: From the Washington Times, Study: Bernanke, Paulson misled public on bailouts

Federal Reserve Chairman Ben S. Bernanke and former Treasury Secretary Henry M. Paulson Jr. misled the public about the financial weakness of Bank of America and other early recipients of the government’s $700 billion Wall Street bailout, creating “unrealistic expectations” about the companies and damaging the program’s credibility, according to a report by the program’s independent watchdog.

Image from Text Artist

In other words, they lied to sell that takeover to the public:

The rationale for giving money to stable banks and not failing ones, regulators said, was that such institutions would be better able to lend money and thus unfreeze tight credit markets – a major factor in last year’s Wall Street losses.

But an audit released Monday by TARP Special Inspector General Neil Barofsky says senior government officials and Wall Street regulators, including Mr. Bernanke and Mr. Paulson, had “affirmative concerns” that several of the nine institutions were financially shaky.

“By stating expressly that the ‘healthy’ institutions would be able to increase overall lending, Treasury may have created unrealistic expectations about the institutions’ condition and their ability to increase lending,” the audit says.

You think?

“Treasury and the TARP program lost credibility when lending at those institutions did not in fact increase and when subsequent events – the further assistance needed by Citigroup and Bank of America being the most significant examples – demonstrated that at least some of those institutions were not in fact healthy.”

The report makes no recommendations but argues that Treasury, the Federal Reserve and other federal agencies “should take more care in publicly characterizing the nature and objectives of their initiatives.”

And pigs will fly. Washington still has healthcare “reform” to get off the shelves.

This is how President Obama’s top economic adviser Larry Summers measures success: Larry Summers cites Google search as progress

Of all the statistics pouring into the White House every day, top economic adviser Larry Summers highlighted one Friday to make his case that the economic free-fall has ended.

The number of people searching for the term “economic depression” on Google is down to normal levels, Summers said. Searches for the term were up four-fold when the recession deepened in the earlier part of the year, and the recent shift goes to show consumer confidence is higher, Summers told the Peterson Institute for International Economics.

More at the link.

If you buy that, I know of a bridge for sale.

Another apparently unregarded consequence of cap and tax: From The Foundry, How Cap and Trade Affects the Health Care Debate

…Though it would be nearly impossible to trace out all the impacts of higher energy costs on medical services, one broad measure is the impact on the costs of medical care. By driving up energy costs, Waxman-Markey will drive up the costs of running hospitals, manufacturing medical equipment, producing drugs, driving ambulances and virtually every other component of our healthcare system…

…So what happens to healthcare? On top of all the other factors that will lead to higher prices down the road, Waxman-Markey will add an additional 11.6 percent to healthcare costs by 2035 (the last year of the analysis). So, though Waxman-Markey aims its economic bombs at global-warming, healthcare will suffer hundreds of billions of dollars in collateral damage each year.

A meeting of the minds from both ends of the political spectrum: When Do We Get That Job ‘Surge’?

Presidents generally enjoy a honeymoon both because the public wants their presidents to succeed and because in the early stages of a presidency the mistakes, lies, and screw-ups have not yet materialized. But soon they do. And in the case of this presidency, the non-stimulus plan is proving to be the equivalent of the first serious fight between the newlyweds.

The stimulus plan was bad policy, poorly conceived and oversold. It isn’t working, yet the president insists his policy was perfect. The result now is a surprising agreement between the Left and Right.

On the Left, Bob Herbert chimes in:

“Vice President Joe Biden told us this week that the Obama administration “misread how bad the economy was” in the immediate aftermath of the inauguration. Puh-leeze. Mr. Biden and President Obama won the election because the economy was cratering so badly there were fears we might be entering another depression. No one understood that better than the two of them. Mr. Obama tried to clean up the vice president’s remarks by saying his team hadn’t misread what was happening, but rather “we had incomplete information.”

On the Right, House Minority Leader John Boehner calls foul:

“I found it … interesting over the last couple of days to hear Vice President Biden and the president mention the fact that they didn’t realize how difficult an economic circumstance we were in. … Now this is the greatest fabrication I have seen since I’ve been in Congress. I’ve sat in meetings in the White House with the vice president and the president. There’s not one person that sat in those rooms that didn’t understand how serious our economic crisis was.”

Hmm. We have consensus. And the president has a problem, both on policy and on credibility.

Much more at the link.

H/T Instapundit

Anticipating fireworks of a different kind: US lurching towards ‘debt explosion’ with long-term interest rates on course to double

The US economy is lurching towards crisis with long-term interest rates on course to double, crippling the country’s ability to pay its debts and potentially plunging it into another recession, according to a study by the US’s own central bank

In a 2003 paper, Thomas Laubach, the US Federal Reserve’s senior economist, calculated the impact on long-term interest rates of rising fiscal deficits and soaring national debt. Applying his assumptions to the recent spike in the US fiscal deficit and national debt, long-term interests rates will double from their current 3.5pc.

The impact would be devastating by making it punitively expensive to finance national borrowings and leading to what Tim Congdon, founder of Lombard Street Research, called a “debt explosion”. Mr Laubach’s study has implications for the UK, too, as public debt is soaring. A US crisis would have implications for the rest of the world, in any case.

Much more at the link.